BOE Lowers Rates as Internal Split Widens in 2025 Decision

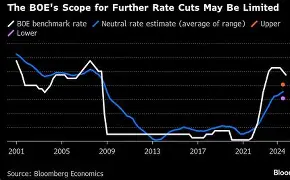

The Bank of England has reduced its base interest rate by 25 basis points to 4.0 percent, responding to continued signs of economic weakness in the UK. This marks the fifth rate cut in the last 12 months, a sharp reversal from the tightening cycle of previous years. The move follows two consecutive months of GDP contraction and rising unemployment, now at 4.7 percent. Inflation remains above target, but policymakers cited growing risks to growth and labor markets.

The rate decision revealed a rare deadlock among the nine-member Monetary Policy Committee. Four members voted to keep rates unchanged, four supported the 0.25-point cut, and one called for a steeper 0.5-point reduction. A second vote broke the tie, with external member Alan Taylor siding with the majority favoring the smaller cut. This outcome highlights how divided the committee remains on how to balance inflation control with economic support.

UK economic data pointed to deeper structural pressures. Consumer spending weakened, business investment slowed, and high energy costs continued to weigh on production. Although inflation held at 3.6 percent in June, well above the 2 percent target, the central bank projected a gradual easing by late 2025. The rate cut reflects a strategic pivot toward maintaining fragile growth while remaining cautious about reaccelerating inflation.

Markets responded swiftly to the decision. The British pound rose 0.4 percent to $1.3405, while two-year government bond yields climbed above 3.88 percent. Analysts described the outcome as a “hawkish cut,” meaning the rate drop came with signals that further easing would be measured. The narrow vote suggests future decisions will remain contentious as the bank navigates global and domestic volatility.

This rate cut signals a critical juncture for UK monetary policy in 2025. While central banks globally weigh similar tradeoffs, the BOE’s internal divide illustrates growing uncertainty over long-term inflation dynamics and economic resilience. Investors, policy analysts, and international partners will monitor the UK’s path closely, especially in the context of currency strength, export competitiveness, and consumer sentiment.